slice Unveils India’s First UPI-Powered Credit Card and Bank Branch

Revolutionizing Credit Access with the slice UPI Super Card

UPI ಕ್ರೆಡಿಟ್ ಕಾರ್ಡ್ ಮತ್ತು ಡಿಜಿಟಲ್ ಬ್ಯಾಂಕ್ ಶಾಖೆಯೊಂದಿಗೆ ಸ್ಲೈಸ್ ಬರೆಯುತ್ತಿದೆ ಹೊಸ ಇತಿಹಾಸ!

Bengaluru, June 30, 2025 – In a landmark move for India’s financial sector, slice today launched its flagship slice UPI credit card, a breakthrough product designed to redefine credit accessibility. Alongside this, the company unveiled India’s first UPI-powered bank branch and ATM, marking a bold step toward blending digital innovation with physical banking convenience.

The slice UPI credit card eliminates traditional barriers with no joining or annual fees, offering a seamless credit experience that integrates effortlessly with UPI transactions. Users can scan QR codes or make UPI payments directly from their credit line, earning up to 3% cashback on all spends. Additionally, the slice in 3 feature allows instant conversion of purchases into three interest-free instalments.

Democratizing Credit for Millions

With UPI revolutionizing digital payments for over 400 million Indians, a significant portion—over 200 million users—remain underserved in formal credit. slice aims to bridge this gap by leveraging its full-stack banking infrastructure, a rarity in the fintech space, as it operates independently after merging with NESFB.

Satish Kumar Kalra, MD & CEO of slice, emphasized the transformative potential of this launch:

“In my 40 years of banking, I have witnessed several milestones, but this is a revolution in how India perceives finance. We are rebuilding banking from the ground up—merging technology, simplicity, and trust to serve every Indian. Credit on UPI will be the next giant leap for financial inclusion.”

Reimagining the Credit Card for the UPI Era

Traditional credit cards, largely unchanged for 75 years, face a critical need for reinvention in India’s digital-first economy. Rajan Bajaj, Founder and Executive Director of slice, highlighted the shift:

“Credit on UPI is the natural next step for India’s spending habits. It’s not just about digitizing the credit card—it’s about rethinking credit itself. We must ensure fraud-proof, scalable solutions while extending credit to those who truly deserve it.”

Bajaj also outlined slice’s vision for UPI ATMs, which aim to reduce cash-handling costs, making basic banking viable for a billion Indians.

A Glimpse into the Future of Banking

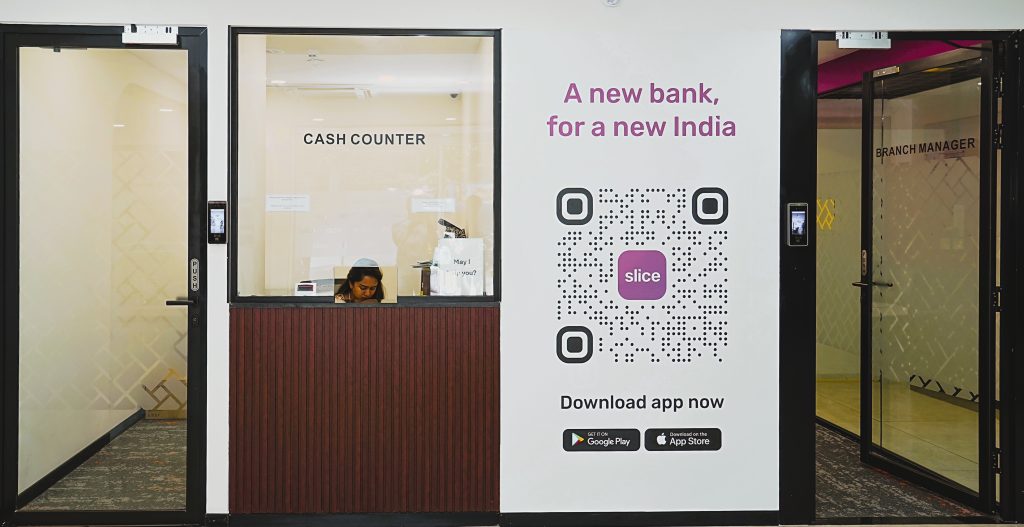

The newly launched slice UPI-powered bank branch in Koramangala, Bengaluru, redefines customer experience with:

-

Complete UPI integration across all transactions

-

Instant onboarding with minimal paperwork

-

Self-service kiosks for account openings and product exploration

-

UPI ATMs enabling cash deposits and withdrawals

This hybrid model—combining digital agility with physical accessibility—positions slice as a pioneer in India’s next-generation banking landscape. As Kalra noted, “This is just the beginning of a journey that will redefine finance as we know it.”

With these innovations, slice is not just introducing new products but reshaping the very fabric of banking—making it faster, simpler, and more inclusive for every Indian.

Contact For Media Updates: +91-93531 21474 [WhatsApp]

Key Quotes:

-

Satish Kumar Kalra, MD & CEO, slice:

“Credit on UPI will be the next giant leap for financial inclusion in India. We’re not just digitizing banking—we’re reimagining it from scratch.” -

Rajan Bajaj, Founder & Executive Director, slice:

*”The credit card is a 75-year-old product. In India, it must evolve with UPI at its core to truly serve millions.”* -

On UPI ATMs:

“Our goal is to make cash deposits and withdrawals so affordable that banking becomes viable for a billion Indians.”

![]()